Table of contents

- Quick Comparison

- The 7 Best High Yield Savings Accounts of 2025

- 1. Ally Bank High-Yield Savings Account

- 2. Marcus by Goldman Sachs Online Savings Account

- 3. Capital One 360 Performance Savings

- 4. Discover Online Savings Account

- 5. Synchrony High-Yield Savings Account

- Picking a High-Yield Savings Account

- Growing Your Emergency Fund

- Summary

High-yield savings accounts are a great way to grow your emergency fund while keeping your money safe and accessible. In 2025, the best options offer APYs above 4%, no fees, and FDIC insurance up to $250,000. Here’s a quick summary of the top choices:

- Ally Bank: 4.35% APY, no fees, $0 minimum balance.

- Marcus by Goldman Sachs: 4.30% APY, no fees, $0 minimum balance.

- Capital One 360: 4.25% APY, no fees, $0 minimum balance.

- Discover: 4.20% APY, no fees, $0 minimum balance.

- Synchrony: 4.15% APY, no fees, $0 minimum balance.

Quick Comparison

| Bank | APY | Monthly Fees | Min. Balance | FDIC Insurance |

|---|---|---|---|---|

| Ally Bank | 4.35% | None | $0 | Yes |

| Marcus | 4.30% | None | $0 | Yes |

| Capital One 360 | 4.25% | None | $0 | Yes |

| Discover | 4.20% | None | $0 | Yes |

| Synchrony | 4.15% | None | $0 | Yes |

Choose an account with features like automatic transfers, round-up savings tools, and user-friendly apps to make saving easier. Prioritize accounts with no fees and high APYs to maximize growth. Always ensure your deposits are FDIC-insured for peace of mind. Read on for detailed reviews and tips to grow your emergency fund.

The 7 Best High Yield Savings Accounts of 2025

1. Ally Bank High-Yield Savings Account

Building an emergency fund? You need an account that helps your money grow without unnecessary fees. Ally Bank's High-Yield Savings Account fits the bill with its simple, fee-free setup.

Key Features:

| Feature | Details |

|---|---|

| Minimum Balance | $0 (no minimum) |

| Monthly Fees | None |

| FDIC Insurance | Yes |

This account offers a hassle-free way to grow your savings while keeping your funds secure and easily accessible.

2. Marcus by Goldman Sachs Online Savings Account

Marcus by Goldman Sachs offers a straightforward savings account designed to make saving easy and accessible.

Key Features:

| Feature | Details |

|---|---|

| Minimum Balance | $0 (no minimum) |

| Monthly Fees | None |

| FDIC Insurance | Yes |

| Account Access | Online and mobile banking |

With no fees and no minimum balance, you can start saving with any amount. Plus, your deposits are protected by FDIC insurance up to federal limits.

The online platform is user-friendly, allowing you to monitor your savings, set up automatic transfers, and track your progress - all from your computer or mobile device.

3. Capital One 360 Performance Savings

Capital One 360 provides a solid choice for building your emergency fund with its Performance Savings account. This account combines ease of use with reliable security features.

Key Features:

| Feature | Details |

|---|---|

| Minimum Balance | $0 |

| Monthly Fees | None |

| FDIC Insurance | Covers up to $250,000 |

This account's no-minimum balance requirement and lack of monthly fees make it hassle-free to manage. Plus, deposits are protected by FDIC insurance up to $250,000 per depositor, giving you peace of mind while growing your emergency savings. Every dollar you save goes straight toward your financial goals without any hidden costs.

sbb-itb-b2789ac

4. Discover Online Savings Account

Discover provides a strong choice for fee-free savings, standing out with its straightforward features and benefits.

Key Features:

| Feature | Details |

|---|---|

| Minimum Balance | $0 |

| Monthly Maintenance Fee | None |

| FDIC Insurance | Covers up to $250,000 |

With no minimum balance requirement and no monthly fees, Discover's Online Savings Account is an easy-to-manage option. Plus, your money is protected with FDIC insurance up to $250,000, making it a reliable place to grow your emergency fund.

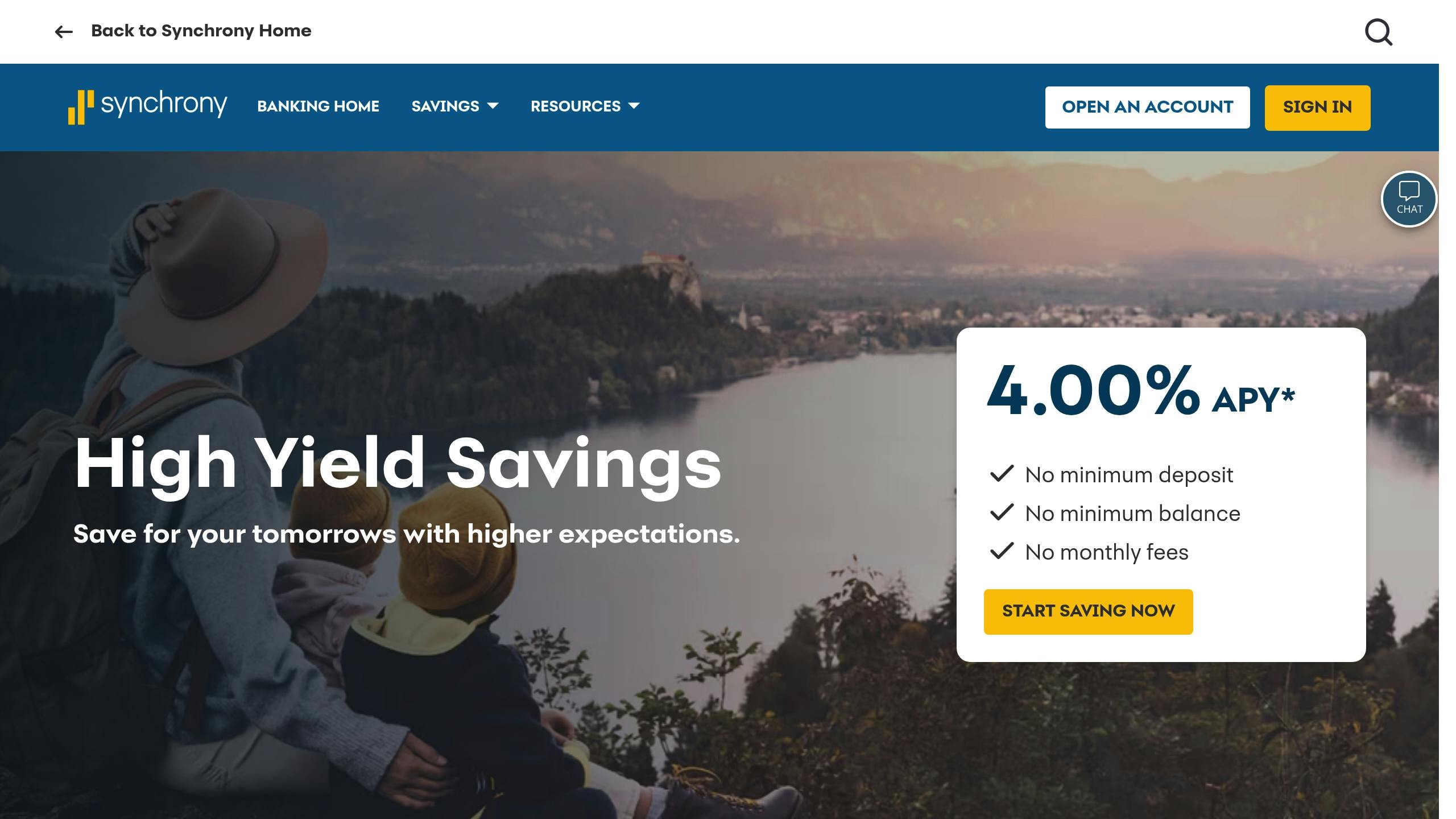

5. Synchrony High-Yield Savings Account

Synchrony Bank provides a simple high-yield savings account with no fees and no minimum balance requirement. Plus, your deposits are insured by the FDIC for up to $250,000.

Key Features:

| Feature | Details |

|---|---|

| Minimum Balance | $0 |

| Monthly Maintenance Fee | None |

| FDIC Insurance | Up to $250,000 |

This is a hassle-free way to grow your emergency savings. Up next, explore how to pick the right high-yield savings account to make the most of your emergency fund.

Picking a High-Yield Savings Account

Make sure the bank is covered by FDIC insurance. This protects deposits up to $250,000 per depositor, per bank. If your funds exceed this limit, you can spread your deposits across multiple FDIC-insured banks or use different ownership categories to ensure full coverage. To double-check a bank's FDIC status, use the FDIC BankFind tool.

Think about how to organize your funds to stay within the insured limits while still earning the best returns. Splitting deposits between banks or using different account ownership setups can help keep your money safe.

Once that's sorted, explore ways to grow your emergency fund faster.

Growing Your Emergency Fund

Once you've picked a high-yield savings account, try these strategies to grow your emergency fund effectively.

Set Up Automatic Transfers

Automate transfers from your checking account to your savings every payday. This makes saving consistent and ensures your fund grows without extra effort.

Use Round-Up Programs

Take advantage of round-up features that round your purchases to the nearest dollar and transfer the difference into your savings. These small contributions can add up significantly over time.

Track Your Progress

Keep an eye on your progress using your bank’s tools. Set specific milestones, like saving enough to cover one month, three months, and eventually six months of expenses.

Let Interest Work for You

Avoid dipping into your fund unless absolutely necessary. This allows compound interest to do its job. Ensure any interest earned is automatically reinvested to maximize growth, especially if your account offers a competitive APY.

Add Windfalls to Your Fund

Got a bonus, tax refund, or some unexpected cash? Put it directly into your emergency fund to boost your savings faster.

Review and Adjust as Needed

Every few months, review your savings plan. Adjust your contributions if your income or expenses change, ensuring your fund stays on track while balancing other financial goals.

These steps can help you build a reliable financial safety net, giving you peace of mind for unexpected expenses.

Summary

| Bank | Key Features | APY | Min. Balance |

|---|---|---|---|

| Ally Bank | No monthly fees, 24/7 customer service, bucket savings feature | 4.35% | $0 |

| Marcus by Goldman Sachs | No fees, same-day transfers up to $100,000 | 4.30% | $0 |

| Capital One 360 | Branch access, mobile check deposit, automatic savings | 4.25% | $0 |

| Discover | Cash-back debit rewards, no hidden fees | 4.20% | $0 |

| Synchrony | ATM card access, no minimum balance | 4.15% | $0 |

These accounts offer a mix of strong interest rates and essential protections for your emergency savings.

Features to Look For:

- High APY: Look for rates above 4% to maximize growth.

- No Fees: Avoid accounts that chip away at your savings with hidden charges.

- Fast Access: Ensure you can retrieve your money when needed without delays.

- FDIC Coverage: Protects deposits up to $250,000.

- User-Friendly Banking: Simple online and mobile tools for convenience.

Choosing an account with these features ensures your emergency fund grows while remaining easily accessible and secure.